Boosting Rental Yields: The Case for Investing in Co-Living Properties

₹ 6,500,000

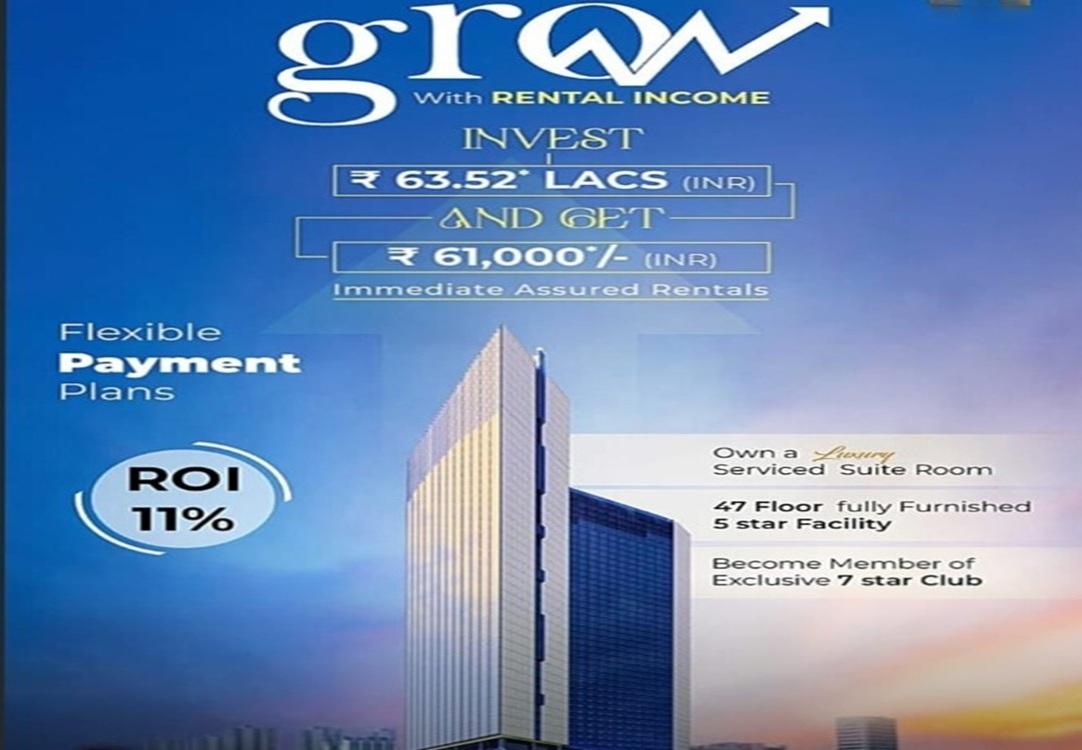

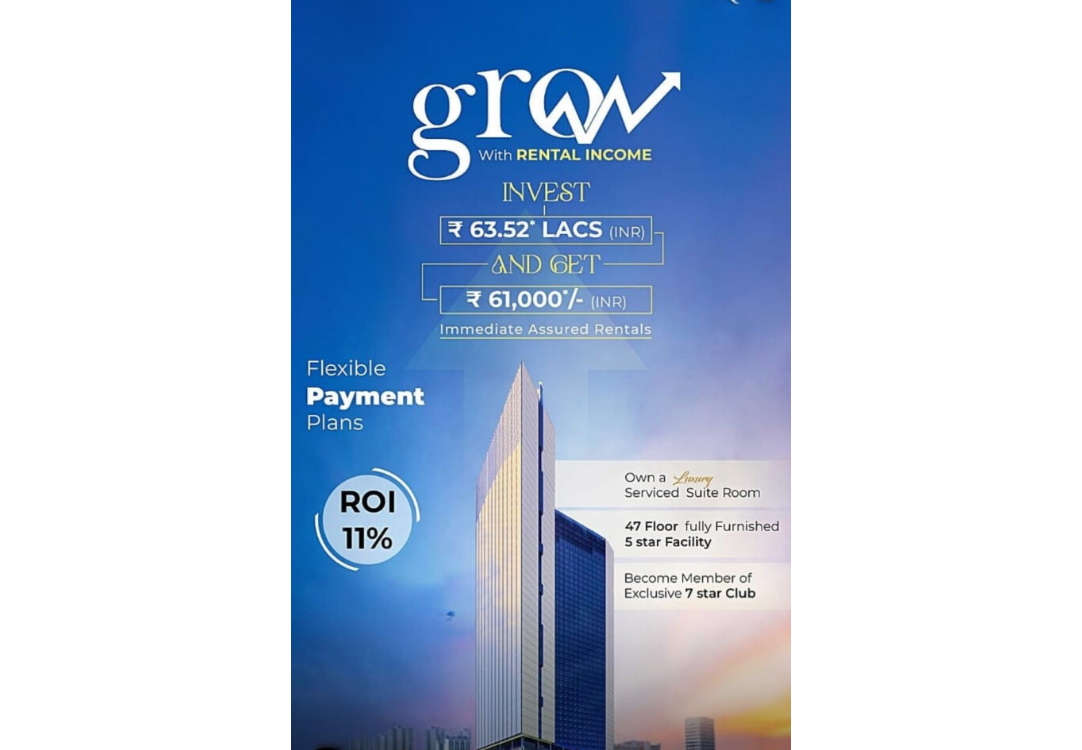

Co-living properties have rapidly gained traction in India’s urban markets, offering investors robust rental yields significantly higher than traditional residential rentals. With an investment of ₹65 lakhs, you can secure a co-living unit or apartment in a desirable city location. These properties generally see annual rental yields ranging from 6% to 10%, sometimes even higher, depending on location and management quality. A 6% ROI on ₹65 lakhs translates to ₹3.9 lakhs per year in gross rental income.

Co-living offers enhanced returns through:

Multiple tenants per property: Maximizing income via room-wise rentals

Consistently high occupancy rates: Driven by strong demand from students and young professionals

All-inclusive rent: Covering utilities, Wi-Fi, and amenities, attracting tenants looking for convenience and community living

Low vacancy risk: As demand remains strong in metro cities and student hubs

Investment at this level typically includes fully furnished spaces, property management, and access to common amenities like housekeeping, security, and recreational zones. As the sector continues to expand—with national occupancy rates in leading markets often above 85%—co-living stands out as a strong avenue for property investors seeking reliable yields and long-term growth.

-

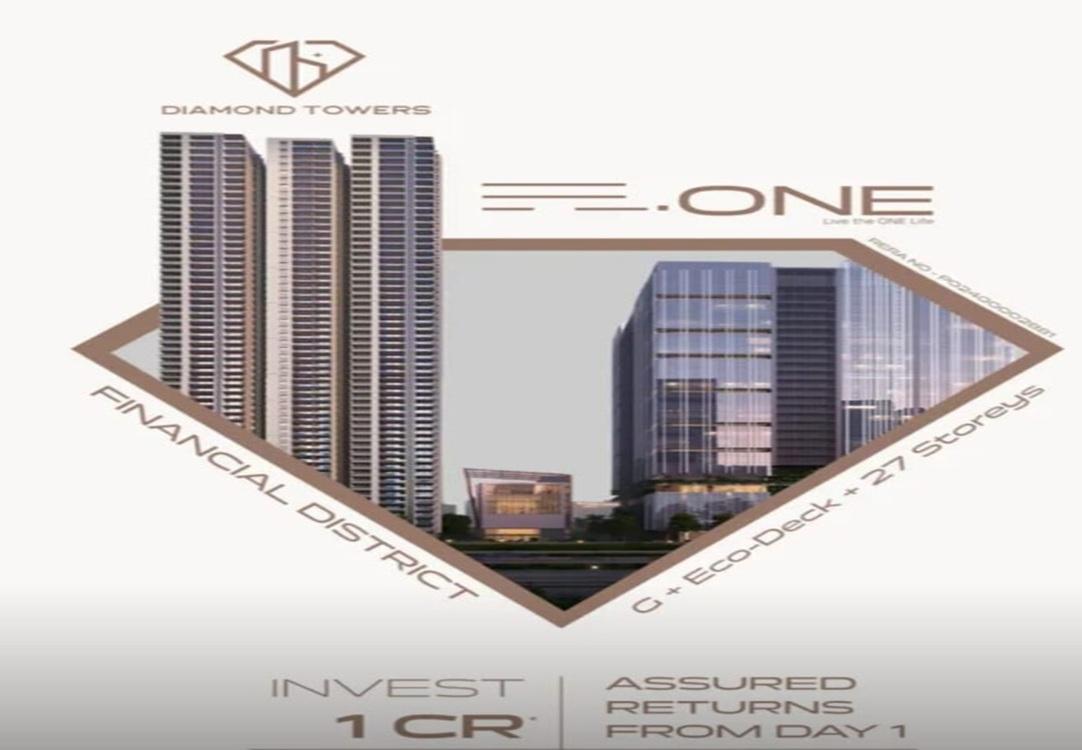

AddressHyderabad, Telangana

The Most Recent Estate

Hyderabad, Telangana

- 0

- 0

- 0 m²